Table of Contents

What Is Wave?

Wave is a free accounting software that is cloud-based and offers management of small business, freelance, and entrepreneurship finances, easily. Wave is very, simple to use, with an uncomplicated interface that allows invoicing, expense tracking, and accounting without a need for advanced financial literacy.

Wave is affordable and provides a practical solution for business owners. Wave provides bookkeeping, invoicing, and financial reporting, conveniently in one place. The remainder of Wave’s significant attributes is beneficent and charge-free, as opposed to other accounting software that demands monthly fees.

This Company allows users to create and send professional invoices, and connect their bank accounts for automatic transaction syncing, income, and expense tracking, without any issues, and it provides reports with clear financial insights to assist users in making better business decisions.

As of 2025 Wave is still one of the most popular accounting platforms for small businesses that want efficient, accessible, and budget friendly financial software. Wave will provide all the tools you need to organize your finances before your discount or bank account runs out, whether you are freelancer or small business owner.

Wave Features Overview

This Company is a comprehensive accounting tool aimed at easing the financial hurdles of freelancers and small business owners. What makes Wave unique is that it aspires to provide the same caliber of tools that you would find at a professional firm for a fraction of the cost. So, let’s take a look at Wave’s key features that affirm its place in the arsenal of the best free accounting tools available in 2025.

Invoicing and Billing

With Wave, it’s easy to create and send invoices. You can customize invoice templates with your own logo, set up recurring billing, and automatically send payment reminders. Wave also allows your clients to pay directly from the invoice so it can enhance cash flow.Invoicing and Billing

Expense Tracking and Receipts

This Company helps you track every business expense in one location. You can connect your bank account and automatically import transactions, or upload receipts via the mobile app. The software will also help you categorize expenses to prepare for taxes or financial reports.

Accounting Dashboard and Reports

This Company dashboard will give you a very good “snapshot” of your business’s finances — income, expenses, profit, and cash flow. You can also quickly generate several detailed reports — balance sheet, income statement, and tax summary — at the click of the button.

Payment Processing and Integration

This Company makes it easy to collect payments online, giving your customers the ability to pay by credit card or bank transfer. Payments will be recorded automatically in your accounting records. Furthermore, Wave will seamlessly integrate with Wave Payroll, Wave Advisors, and other third-party applications.

Mobile Access

With This Company’s mobile app, you can manage your business finances from anywhere. Send invoices, capture receipts, or monitor payments, all directly from your phone — perfect for busy entrepreneurs on the go.

t all comes together in a simple and powerful way — This Company brings small businesses everything they need to take care of accounting tasks free of charge.

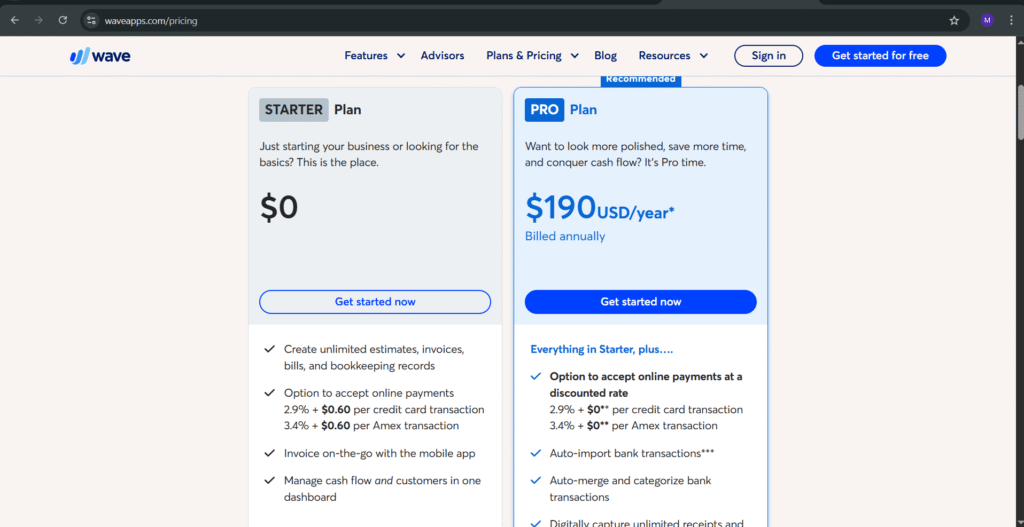

Wave Pricing 2025: Is It Really Free?

One of the main reasons owners of small businesses use This Company is because its accounting software is entirely free. Most software has common features locked behind a paywall, but Wave provides full accounting, invoice, and receipt tracking without any cost.

Still, while This Company Accounting product is free, a few premium services paid for (like payments and payroll) incur a small fee. This pay-as-you-go structure is appealing to freelancers and small businesses who want powerful tools without paying monthly fees.

Below is a detailed breakdown of This Company’s pricing in 2025:

| Feature | Pricing (2025) | Details |

|---|---|---|

| Accounting | Free | Manage income, expenses, and reports with no limits. |

| Invoicing | Free | Create and send unlimited invoices and estimates. |

| Receipts & Expense Tracking | Free | Track expenses and upload receipts through mobile app. |

| Payments | Pay-per-use | 2.9% + 60¢ per credit card transaction, 1% per bank payment. |

| Payroll (U.S. & Canada only) | From $20/month + $6 per employee | Includes tax filing and direct deposit. |

| Advisors & Coaching | Custom Pricing | Access professional bookkeeping and tax support. |

In short, This Company is free for essential accounting tasks, and you only pay if you need payment processing or payroll services. This flexibility gives small business owners the freedom to scale their operations without overspending.

If you’re looking for a budget-friendly accounting solution in 2025, Wave remains one of the best free options available.

Ease of Use

This Company stands out in terms of usability for accounting software for a small business. Designed for freelancers and startups, and non-accountants, Wave lavishes users with its simple design and component specified for managing finances.

This Company is easy to get started with and can take only a few minutes to create an account. The dashboard has a simple design, looks great, and is easy to use, even for users without accounting experience. The features of invoicing, expense management, and generating reports is sorted and with a few clicks they are available to use.

The drag-and-drop to upload the receipts and also connect your bank account to Wave makes day-to-day bookkeeping simple. Plus Wave’s automations for recurring invoices and auto-expenses help save time that business owners can use for growth.

This Company is also cloud-based, which allows for users to use their bookkeeping make data wherever they are. Wave has a mobile app too, which makes tracking expenses while on the move and sending invoices very easy, and stays on top of your bookkeeping tasks.

Overall This Company is one of the easiest accounting software to learn and use. Because it is easy to use and designed with the user experience in mind, Wave is designed for small business owners who want the features of professional scale accounting with zero learning curve.

Wave Pros and Cons

When it comes to managing small business finances, This Company is one of the best free accounting solutions available. However, similar to any software, there are pros and cons. Below is a brief and objective overview of the pros and cons in 2025 for using Wave.

✅ Pros

Free Accounting Software

One of the main attractions of This Company is that it is free to use for its core accounting functions: invoicing, expense tracking, and reporting . This is perfect for freelancers and small businesses who do not have a lot of resources available.

User-Friendly Interface

Pretty much everyone remarks that Wave has clean and simple aesthetics. That means you can create invoices, manage receipts, and track expenses quickly and easily, even if you have no accounting experience.

Professional Invoicing Features

You can create customizable invoices, accept payments online, and send payment reminders. This allows small businesses to receive payments quicker and appear more professional.

Online Access

This Company is an online platform, so you can access your financial data anytime and from anywhere. Your information automatically syncs between devices, which is ideal for small business owners on the go.

Secure

This Company uses bank-level encryption to keep user information and transactions secure. Security is a top priority, so users can feel confident that their business’s sensitive financial information is safe and secure.

❌ Cons

No Advanced Features

This Company is fine for basic needs, but it does not include advanced features like tracking inventory, project management, or advanced financial forecasting, which larger companies may need.

Pay for Payroll and Payment Add-Ons

On the downside, even though Wave is free, you have to pay for payroll and payment processing services. If you are trying to find a completely free option, this is a drawback.

No Direct Support for Free Users

When you use Wave for free, you have access to help articles and forums, but if you would like to use live chat or phone support, you have to pay for an add on. This doesn’t help if you have technology issues.

Not Suitable for Large Businesses

This Company works best for freelancers, solo entrepreneurs, and small businesses. As you grow your business and your accounting becomes more complex, you may quickly outgrow This Company.

Wave Security and Customer Support Review 2025

When you’re dealing with finances online, security and support are two very important considerations to keep in mind. Luckily for users, Wave takes both seriously and seeks to provide security and assistance users can count on.

This Company uses bank-level encryption (256-bit SSL) to protect your financial information. This means you can feel confident that all of your transactions, invoices, and business information are securely stored in the cloud and protected from outside interference. The platform uses secure servers and automatic backups, so even if your device is lost or broken, your accounting data will remain safe.

With respect to your information’s privacy, Wave indicates it follows industry standards and will never share sensitive information from users with other organizations for any purpose without your consent. Wave users can protect their data even further by implementing two-factor authentication (2FA) in order to access their account.

This Company also has various customer support options. in addition to all of the free assistance Wave provides through its help center, community forums, and step-by-step guides FREE users can contact Wave. Users who have purchased Wave Payroll or Wave advisors – those who pay for services – can efficiently get answers to their questions through live chat or emailing – followed up with rapid responses. In 2025, Wave continues to enhance response times and include new in-app help functions to further assist new users.

In short, This Company does a good job in providing solid security and reliable support for small business owners who care about safety and simplicity. Although there is limited support for the free users, This Company focuses on data security and simply guiding you, making it a trustworthy choice for managing your money online.

Wave vs Competitors: How It Stacks Up in 2025

When selecting accounting software, it is wise to evaluate how This Company stacks up to other popular tools in and outside of Wave, QuickBooks, FreshBooks, and Zoho Books. This Company’s main selling features are that it is free and easy-to-use, especially for small businesses and freelancers; however, it does have some restrictions relative to the limitations of a paid software license.

Below is a brief comparison to familiarize yourself with the differences:

| Feature / Platform | Wave | QuickBooks | FreshBooks | Zoho Books |

|---|---|---|---|---|

| Pricing | Free (Paid add-ons) | Starts at $25/mo | Starts at $17/mo | Starts at $15/mo |

| Invoicing & Billing | ✅ Unlimited invoices | ✅ Limited per plan | ✅ Unlimited invoices | ✅ Unlimited invoices |

| Expense Tracking | ✅ Yes | ✅ Yes | ✅ Yes | ✅ Yes |

| Payroll | Paid add-on | ✅ Yes | Paid add-on | ✅ Yes |

| Automation | Basic | Advanced | Medium | Medium |

| Ease of Use | ⭐⭐⭐⭐⭐ Very Simple | ⭐⭐⭐ Complex | ⭐⭐⭐⭐ Easy | ⭐⭐⭐⭐ Easy |

| Best For | Freelancers, Startups | Small to Medium Biz | Service-Based Biz | Small to Medium Biz |

Main Points:

This Company is the best option for beginners, freelancers, startups, and small businesses looking for a free, no-frills option without skipping any of the vital accounting features.

QuickBooks is much more advanced with tools and automation than the alternatives we selected here, but you will pay a higher price.

FreshBooks is ideal for service-based businesses looking for invoicing and client management functionality.

Zoho Books is a good choice for small businesses looking for low-cost, cloud-based accounting.

In the end, Wave is still a go-to for people who want accounting functionality that is easy to use, affordable, and contain the essentials, especially as you are starting your business.

Final Verdict

After thoroughly reviewing Wave, there is no question that it is one of the top free accounting software options available in 2025 for freelancers and small businesses. With Wave’s intuitive interface, its effectiveness when working with small businesses’ core accounting tools, and best of all – its free core features – This Company is the best bookkeeping solution for any business that is looking for dependable bookkeeping without the cost of expensive software.

This Company’s free feature-set includes invoicing; expense tracking; basic reporting; and receipt management – providing a holistic and effective foundation for managing small business bookkeeping. If your business decides to need added services such as payroll or payment processing, Wave has a variety of affordable paid add-on services allowing your company to grow, while simultaneously using their accounting platform.

This Company may have some limitations when it comes to advanced automation features compared to their premium competitors, but Wave’s ease-of-use, cloud accessibility, and security features make it a strong option for small businesses, freelancers, and start-up companies.

If you need free, reliable, and user-friendly accounting software – This Company is worth using. Start off with the free plan, get the feel for its features, and only move up to the paid plan if your business needs continue to grow, and even then, Wave remains an extremely affordable choice for small business accounting in 2025.