Table of Contents

Introduction

If you are a small business owner or a freelancer, managing your business finances can be a daunting task. There are many various aspects to keeping track of including bookkeeping, expenses, invoices, and general financial reporting, all of the pieces of your business finances are kept organized a single accounting program like This Company.

This Compnay is straightforward accounting software that simplifies bookkeeping and aligns accounting reports in one space.

If you are inexperienced, unfamiliar, or new to bookkeeping, managing your business finances can be made easier, quicker, and more accurate with available tools on QuickBooks. QuickBooks offers more sophisticated tools, and with a more curated interface, beginners will be able to learn quickly how to manage their business’ finances without the help of an accountant.

In this guide, we will be covering the best This Firm tips and tricks for beginners as we move into a new year 2025, so that you can save time, mitigate errors, and make better financial choices for your business. After reading this article, you will feel confident while navigating This Company and its tools, while streamlining your day-to-day and accounting processes.

Getting Started with QuickBooks (Beginner Setup Guide)

If you are going to use accounting software for the first time, QuickBooks is, by far, the easiest place to start. Designed to help business owners, freelancers, and entrepreneurs keep an organized financial record without the aid of an accountant to do it for you, this beginner setup guide will help you begin with QuickBooks in 2025.

- Choose the Quickbooks Version That’s Right for You

There will be different versions of QuickBooks available, including QuickBooks Online and QuickBooks Desktop. As a beginner, QuickBooks Online is typically the best option because it is cloud-based and can be accessed from any online computer, while also receiving automatic updates for new features. Desktop versions will normally be for businesses needing more advanced reporting options or working offline.

Tip: Be sure to review and compare pricing charts and options before you register for a version.

- Create your QuickBooks Account

Setting up your QuickBooks account is simple:

Visit the QuickBooks website.

Select the version you want, and choose a subscription plan.

Register to sign up using your email address and create a safe password.

Complete the setup wizard which will prompt you to input your business information including your company name, industry, and business type.

You will be organized properly for your business to begin with QuickBooks after the initial setup process is complete.

- Check Out the QuickBooks Dashboard

When you first log in, you will see the QuickBooks dashboard. This is your home base for managing your funds. Some official features include:

Invoices: Create and send professional invoices to clients.

Expenses: Log your business expenses and categorize them for tax purposes.

Banking: Connect your bank accounts and credit cards to automatically update your transactions.

Reports: Create financial reports (profit & loss statements and balance sheets).

Take a moment to find your way around the dashboard. Knowing where everything is will save you time later.

- Basic Preferences

Before you start inputting transactions, you may want to configure your QuickBooks preferences to match your business expectations. Choose things such as:

Setting a fiscal year and accounting method (cash or accrual).

Setting automatic invoice reminders.

Designing invoice templates and uploading your logo and brand colors.

Setting up a payment gateway (i.e., PayPal, Stripe) to accept payments sooner.

Once you get the preferences set up, you will have a seamless QuickBooks experience from day one.

- Connection of Bank Accounts and Credit Cards

One of Company most powerful features is bank integration! Once you sign in to your bank accounts and card accounts, QuickBooks can automatically import your transactions and categorize your expenses, manage your reconciliations.Not only will this save time, but it will also minimize the possibility of making mistakes in your bookkeeping.

Tip: Make it a habit to review the transactions you import on a regular basis to make sure they are categorized properly.

Conclusion:

Beginning This Company doesn’t have to be a hassle. With the appropriate version of QuickBooks, setting up your account, working with the dashboard, setting up your preferences, and linking your bank accounts, you can create an excellent baseline to manage your business finances.

Time-Saving QuickBooks Tips Every Beginner Should Know

Managing your business finances does not need to be burdensome or a huge time-suck. If you apply the correct strategies, This Company can save you hours of work each week. Here are some key tips to save time that all beginners should know:

- Automate Recurring Transactions

Recording recurring bills, invoices, and expenses each time is one of the biggest time-wasters for a new bookkeeper. One of the potential time-saving features of This Company is to set up automated recurring transactions.

Set up recurring invoices for repeat customers.

Set up recurring bill payments for monthly bills or subscriptions.

Utilize bank rules to automate categorizing transactions.

During busy times, automation is great for being consistent and accurate in your records while drastically reducing the amount of work you are doing manually.

- Use Keyboard Shortcuts for Faster Navigation

Navigating through This Comapny efficiently can save a huge amount of time. Keyboard shortcuts facilitate quicker movement without diving into menus. A few helpful shortcuts include:

Ctrl + I – To create a new invoice

Ctrl + W – To create a new check

Ctrl + Q – To bring up the QuickBooks report screen

It may only take you a couple minutes to learn these shortcuts, but the time you save week over week and month over month adds up.

- Tailor Reports for Rapid Insight

Often, when you’re first starting out, you’ll spend hours running generic reports that simply do not lead to decisions. In QuickBooks, you can customize reports with just the facts that are important to you, and we recommend that you do:

Filter by date, customer, category.

Save the customized report for easy access.

Schedule the report to be emailed – for you or your accountant – anytime.

Having information solely for your needs will allow you to make faster, more informed financial decisions.

- Set Categories to Transactions Automatically

Spend time on each expense assigning it a category. This can take a long time, but QuickBooks allows you to set rules to assign categories for recurring transactions. Some examples would be:

Coffee shop-> Office Supplies

Monthly subscription service -> Software/Subscriptions

This will keep your books tidy, and result in fewer errors.

- Integrate Third-Party Applications

For those new to using Quickbooks, integrating applications is a great time-saver! It is possible to integrate your This Company account to services like paypal, shopify or stripe. Some of the benefits being:

Sales and payment data is automatically synced.

Less manual entries mean less errors.

Spending less time each month reconciling.

- Regularly Reconcile Your Accounts

While it may feel burdensome to reconcile accounts on a regular basis, it helps you save time over the long run. This Company helps you reconcile your bank and credit card accounts quickly, getting your records in line with your statements, and help you avoid costly errors.

Pro Tip: Combining these tips can save you significant hours in overall bookkeeping work. New users that automate, create shortcuts, and integrate applications early on tend to find that QuickBooks becomes a vital tool to help you run your business efficiently.

Managing Expenses and Invoices Like a Pro

Knowing how to manage your business finances effectively is one of the most important skills as a small business owner. QuickBooks makes it easier than ever to track expenses and produce invoices. Here’s how to do both like a pro.

- Efficiently Tracking Expenses

It’s essential to stay on top of your expenses if you want to maintain a healthy cash flow. QuickBooks helps you in this regard by allowing you to:

Automatically categorize expenses: Just link your bank and credit accounts to QuickBooks, and it will automatically categorize your transactions.

Easily attach receipts: You can actually snap a picture of a receipt using the QuickBooks mobile app, and attach it directly to your expenses.

View your spending patterns: QuickBooks will generate reports that show you where your money is going, making it easier to determine if you are spending money unnecessarily.

By consistently tracking expenses in QuickBooks, you will make better financial decisions and avoid frustration when preparing your taxes.

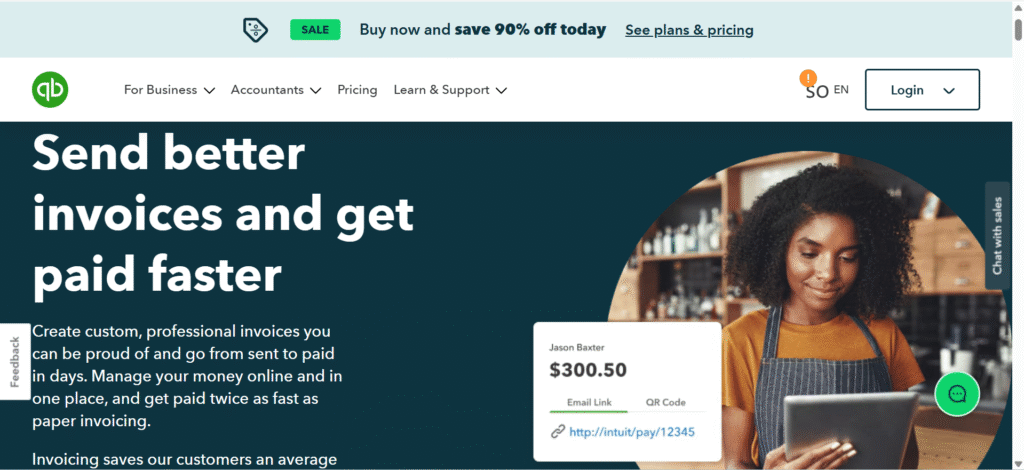

- Create and Submit Professional Invoices

Issuing invoices is an essential factor in the payment process. Using QuickBooks, you can:

Create modified invoices – Include your business’s logo, payment terms, and detailed extent of services so your invoices have a polished touch.

Send invoices instantly – Send invoices via email directly to clients from QuickBooks or set them to send automatically.

Accept multiple payment methods – Accept credit cards, ACH, and PayPal; you will improve your chances of getting paid quickly.

Pro Tip! Consider automating invoices for regular clients to save time and receive their regular payments.

- Integrate Payments To Improve Daily Processes

This Company makes it easy to connect with your payment platforms. QuickBooks integrates with payment systems such as Stripe, PayPal, or Shopify. Payments are automatically entered into QuickBooks when the payment system is linked, reducing manual entries and errors; more importantly, this saves time and sanity.

- Rinse and Repeat Your Invoicing

To ensure accuracy, you want to reconcile your invoices to the payment you receive. The tools QuickBooks has to offer are:

Tracking overdue invoices at a glance.

Sending automated reminders for payment.

Generating reports for age of invoices and cash flow.

Tracking expenses and invoicing clients on a consistent basis helps you not only stay organized, but also helps you make better decisions about when, and how it time to reinvest in your business for increased profitability.

QuickBooks Tricks to Improve Accuracy and Save Money

Keeping track of your finance and accounting is a difficult task, especially if you are new to accounting programs. This Company has some great tricks and features that will help you save time and money and also increase your accuracy. Here are some of the best features and tips every QuickBooks beginner should know.

- Regular Reconciliation

One of the best QuickBooks tips you can utilize to ensure accuracy in your finances is regular reconciliation. Reconciling your accounts will ensure your bank statement and your QuickBooks account balances align, and it will also minimize or eliminate opportunities for accumulated errors. Most people will tell you to reconcile at least monthly. Monthly reconciliations are not as cumbersome as they may seem, but the habit will help you immensely and definitely save you from expensive mistakes. You will also find it easier next tax change with well-organized books.

- Automatic Expense Categorization

No one wants to categorize every transaction mentioned in your bank statement. QuickBooks can help you significantly with automatic expense categorization. Once you get used to, or even just set up auto categorization for monthly expenses like you utility bill that is separate from your other expenses. When you category recurring expenses quickly, you can find and visualize your expenses quickly without human error slowing down the process.

- Use Audit Trails to Monitor Changes

This Company has an in-built audit trail function, which identifies any changes made to your accounts. This is an excellent tool for checking errors and finding out who made them. If you make it a habit to check your audit trail regularly, you will help preserve accuracy and identify mistakes before they escalate.

- Make Useful Reminders for Bills and Invoices

Late payments and unpaid bills often mean added fees and cashflow issues. QuickBooks will allow you to make reminders of upcoming bills, invoice due dates, and things put in your accounts. This will not only restore accuracy but also provide the potential for avoiding needless payments.

- Backup Your Data on Regular Basis

Losing data can be agonizing or damaging to any business. By making a point of backing up your This Company data on a regular basis, you will help to ensure the safety and accuracy of your financial records if anything happens with your computer or internet connection. There are many ways to go about backing up, but if you are using QuickBooks Online you will not need to worry about backups since your work is stored in the cloud. If you are downloading QuickBooks Desktop to your computer of a company or financial nature, you will have to displace it manually in case anything happens-the time and money you spend on this task will control data loss well past where your computer or internet is standby, this method will shore up your financial obligation later on.

Advanced QuickBooks Features You Should Try in 2025

QuickBooks does not solely function as a basic bookkeeping tool. Its advanced features save time, increase accuracy, and provide you with a better understanding of your business finances. If you are a small business owner or an accountant, using the advanced features can elevate your experience in 2025.

- QuickBooks Payroll

Payroll can take a lot of time and can be prone to mistakes. This Company Payroll allows you to manage employee payments, payroll taxes, and filing taxes automatically. Tracking hours, generating paychecks, and deducting money is not stressful with QuickBooks Payroll. Best of all, its payroll features will help you comply with all of the payroll tax laws while minimizing costly errors.

- Inventory Tracking

For businesses that sell products, QuickBooks has strong inventory tracking features. You can monitor inventory levels, track product costs, and it automatically updates its inventory when sales occur. These feature alone will help prevent stock outs and over ordering along with help you operate your business efficiently.

- Integrate third party applications

This Company integrates with services such as, Shopify, Amazon, PayPal, HubSpot, and Excel. Integrations allow sales information to be synced, manage customer data, and streamline reporting. Integration allows QuickBooks to become a central hub for your business operations.

- Enhanced Reporting and Analytics

This Company offers customized reports that go beyond the summary financial statements to provide business performance information. You can look at cash flow, profitability, and sales trends, all of which contribute to better decision-making, identify opportunities for growth, and point to potential cost savings.

- AI and Automation Features in 2025

This Company is integrating AI-powered tools to improve the accounting and bookkeeping experience. Features like automatic categorizations of transactions, predictive cash flow forecasts, and smart suggestions for expenses help save businesses time and reduce errors. Together, these tools create a powerful position for QuickBooks as not just an accounting software system, but a business intelligence tool.

Conclusion

Implementing advanced This Company features can provide a competitive advantage to your business in 2025. Whether exploring payroll automation or AI-driven insights, the tools provided through QuickBooks will help save time, increase accuracy, and provide you the tools to make informed decisions. Try them out today and give yourself the advantage of managing your business finances without reservations.

Final Thoughts: Mastering QuickBooks for Long-Term Success

Learning QuickBooks covers more than just navigating the software based, it supports creating a plan to optimize your business financials and to allow you to make better financial decisions going forward. Newbie users can implement tips and tricks in this guide to transform QuickBooks from a bookkeeping application to a business tool to analyze business financials.

The goal of long-term success with QuickBooks is to maintain accurate records periodically, reconcile your accounts and take advantage of automation as much as possible. All of these will save time, reduce errors and improve the reliability of your financial statements.

You should keep exploring advanced features and integrations to QuickBooks as your business grows. It may incorporate a tool that will empower your productivity in aspects such as QuickBooks Payroll or to manage your inventory, or integrated apps from third party vendors.

Finally, know your journey to master QuickBooks is just that, a journey. Continue to remain current on the latest features and advancements, engage elements of QuickBooks communities, and when appropriate take professional training resources. In the end, your time investment in learning how to better leverage and customize QuickBooks to suit your business needs, will support long-term control, efficiency and success with your business finances.